An early exploration of the formation of such an exchange commissioned by the Dutch Ministry of Economic Affairs and Climate Policy was conducted last year (B. den Ouden, 2020). The exploration concludes that the Netherlands is very well positioned for development of an exchange-based hydrogen trading platform. The Netherlands has a unique position with vast potential for green hydrogen production from offshore wind, the landing of seaborne hydrogen imports, a solid industrial base with large hydrogen subsystems, and, of course, the unique natural gas- and industrial feedstock infrastructure as a gateway to industrial clusters in the Northwestern European hinterland. The Netherlands also has a track record when it comes to energy exchanges as the designer of the system of market coupling of the European electricity exchanges, and the creation of Europe’s leading gas market at the TTF.

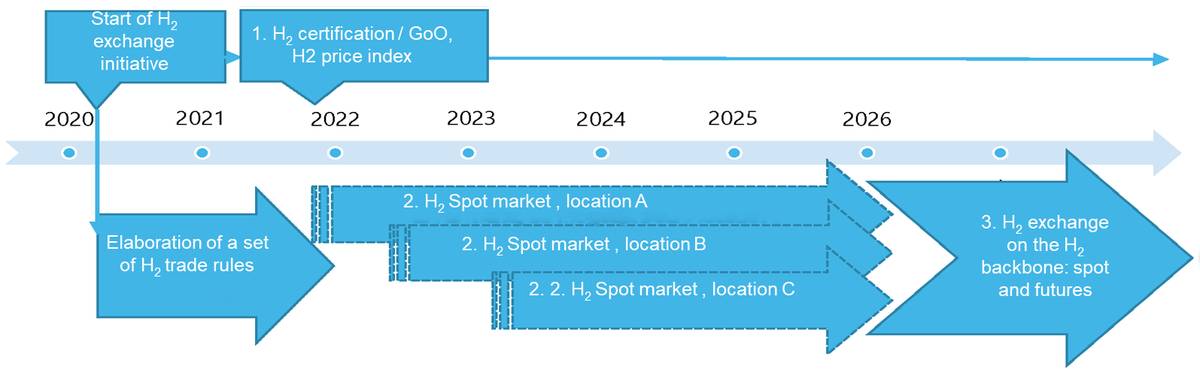

The exploratory study sketches a timeline for platform development and roll-out as illustrated in the figure below. The timetable aligns with the currently envisioned completion of hydrogen backbone by 2026 and beyond (PwC/Strategy&, 2021), preceded by development of regional systems. Regional hydrogen grids at harbour regions are expected to be operational at an earlier stage. From the onset they require establishment and development of hydrogen spot markets and/or an “into pipe” market for seaborne imports.

As follow-up to the exploratory hydrogen exchange report, the key topics for a hydrogen exchange were discussed with market parties. Based on this, four preliminary products were selected for further development. Development of these products is related.

- Certificate product, being a precondition for all other products.

- Spot market product: needed, due to intermittent output profile of electrolyzers. Start by doing a market simulation, to be launched at seaport locations.

- Products for hydrogen grid balancing and storage. To be included in the Spot market simulation.

- Index product: this provides a value to the certificate product.

This PPS proposals concerns the elements 2 and 3. (Elements 1 and 4 are also developed as separate parallel projects, but not treated in this proposal)

Project objective

The study seeks to establish a robust blueprint for a hydrogen exchange in the Netherlands that enables a gradual build-up of a hydrogen exchange covering an expanding geographical market catalysing the envisioned hydrogen system development.

The project will detail an institutional framework for a hydrogen exchange in terms of stakeholder roles, responsibilities and powers for the system operator (system management & operation, transport, quality conversion, balancing mechanism), the market operator (clearing & settlement, counterparty risk management), and market participants (hydrogen production, storage, conversion and deployment). Market efficiency, integrity and robustness of exchange-based hydrogen trading is assessed through extensive market simulations, conducted in close cooperation with partners in the HyXchange initiative and future market participants, building a shared view and confidence in the next steps towards exchanges-based hydrogen trading:

- First, we will explore optimal hydrogen spot market dynamics for a gradually expanding system covering green/blue hydrogen production, pipeline transport, storage and seaborne imports. For this we aim to expand on the existing utilities of TNO’s I-ELGAS model, that calculates optimal (least-cost) market allocation and associated market prices for coupled nodal markets for hydrogen, electricity and methane..

- Second, we will conduct a series of virtual market simulations with market participants using the TNO’s EYE model to assess the impact of bid behaviour and uncertainty. The simulation will both take place within the two regional hubs Port of Rotterdam and North Sea Ports, and at a national level (where it will interact with the broader NW-European energy market and utilise the Gasunie backbone).

The project charts operational design for a hydrogen exchange in terms of market processes such as nominations, allocation, settlement and reconciliation in context of the hydrogen, electricity and natural gas system and associated geographical - and temporal scope, like temporal granularity, trading periods, gate closure and delivery periods, along with associated product specifications in alignment with coupled power and natural gas markets.

Project partners

This project is led by TNO with support of HyXchange. TNO will lead the modelling exercise and further develop the I-ELGAS model and the EYE market simulation model. HyXchange will lead discussions between market parties and act as point of contact for internal and external participants / interested parties to this project.

Other partners in this project are:

- Dutch ports (Port of Rotterdam, Groningen Seaports, Port of Amsterdam, North Sea Ports): project donor

- Gasunie: project donor

- The province of Zuid-Holland: project donor

- Smart Delta Resources: project donor

- A selection of (voluntarily participating) market parties

This PPS-project started in March 2022 and will soon be finished (Q1 2024). Total project cost are nearly €625k, with a TKI subsidy of nearly €300k.

The project has been finished and the reports can be donwloaded from the website of HyXchange: Document Library | Hyxchange.

Please look for the following reports:

- Hydrogen spot market simulation, policy report

- Hydrogen spot market simulation, technical report